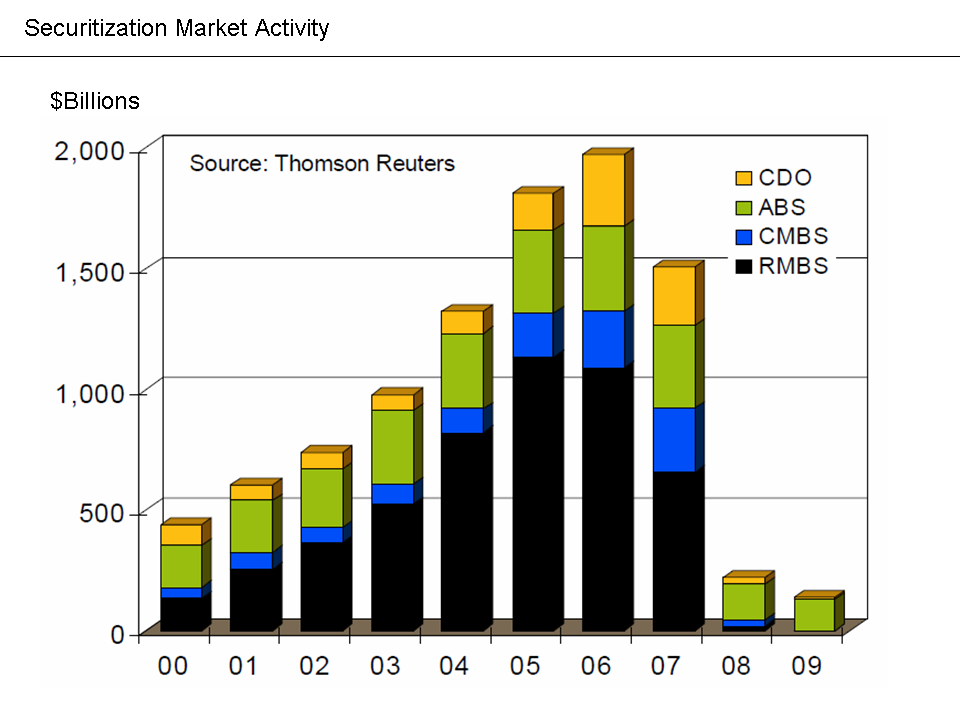

Securitization Market Activity

Explanation

From Economist Mark Zandi's January 2010 testimony to the Financial Crisis Inquiry Commission: "The securitization markets also remain impaired, as investors anticipate more loan losses. Investors are also uncertain about coming legal and accounting rule changes and regulatory reforms. Private bond issuance of residential and commercial mortgage-backed securities, asset-backed securities, and CDOs peaked in 2006 at close to $2 trillion...In 2009, private issuance was less than $150 billion, and almost all of it was asset-backed issuance supported by the Federal Reserve's TALF program to aid credit card, auto and small-business lenders. Issuance of residential and commercial mortgage-backed securities and CDOs remains dormant."[1] Banks and other financial institutions packaged various types of loans (including mortgages) into securities and sold them to global investors. This is called securitization. In exchange for purchasing the investment, the investor receives a right to the cash flows from the underlying loans specified for the security. The chart shows how this financing source dried-up, meaning that non-prime mortgages and other types of loans could not be originated and sold to investors.

Relevantní obrázky

Relevantní články

Americká hypoteční krize 2007Americká krize trhu s hypotékami, která v červenci a srpnu 2007 vyústila ve finanční propad burzovních trhů v USA, byla způsobena rizikovými hypotečními úvěry. Kvůli propojenosti trhů se tato krize rychle přelila do celého světa a nakonec přerostla ve světovou finanční krizi. .. pokračovat ve čtení